If you’ve been trading stocks or cryptocurrencies for a while, you’ve probably heard of chart patterns that traders rely upon to make informed decisions. Among these patterns, the Cup and Handle formation stands out as one of the most reliable and profitable indicators for predicting bullish breakouts. But what exactly is the Cup and Handle pattern, and how can you leverage it to enhance your trading strategy?

In this comprehensive guide, we’ll deep dive into the intricacies of the Cup and Handle pattern, share actionable trading strategies, highlight real-world examples, and explore the latest trends in both stock and crypto markets. Whether you’re a beginner or an experienced trader, understanding this powerful pattern can significantly boost your trading performance.

What is the Cup and Handle Pattern?

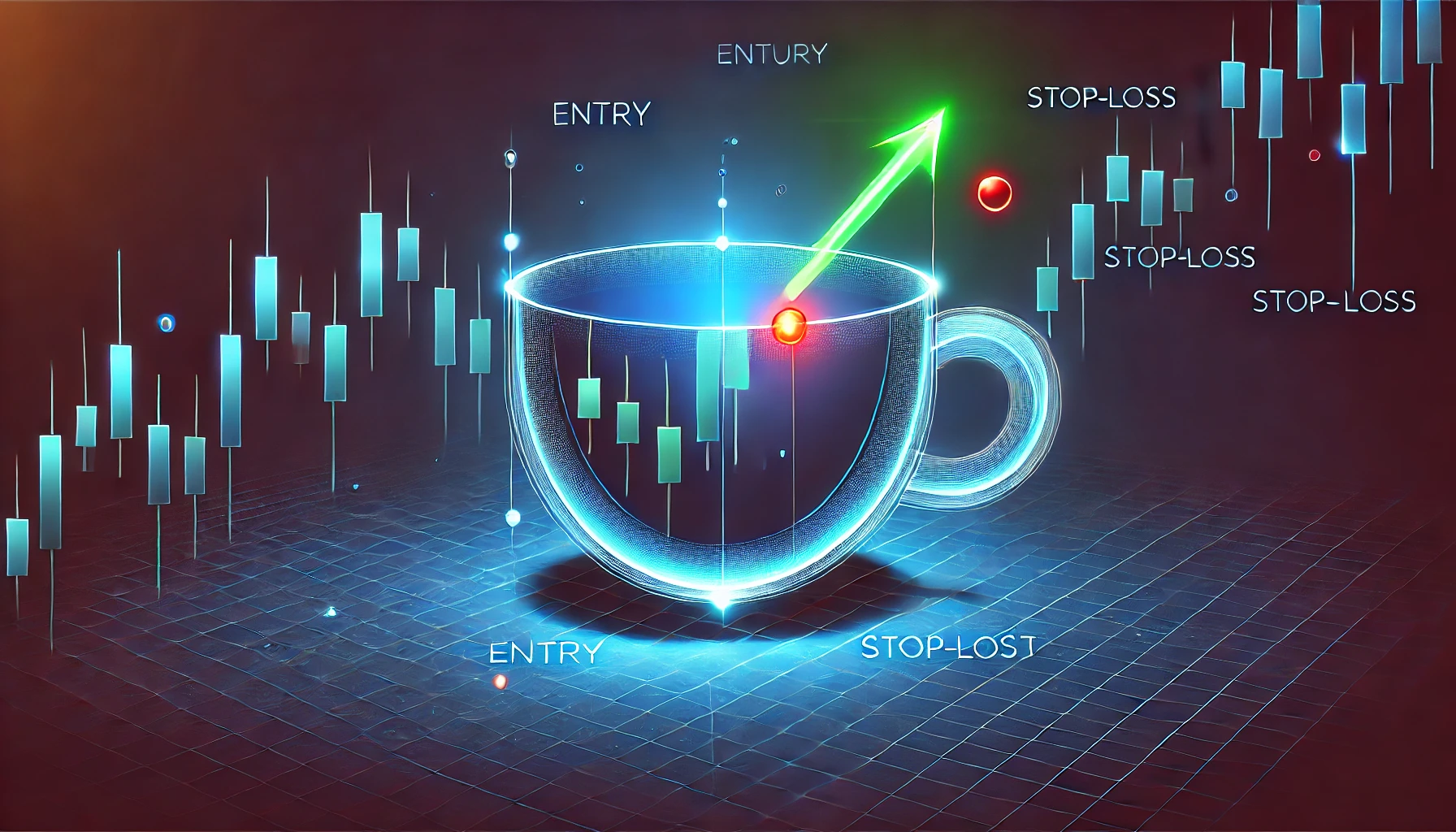

The Cup and Handle pattern, first identified by renowned investor William J. O’Neil, is a bullish continuation pattern that signals the potential for an asset’s price to increase significantly. It resembles a tea cup viewed from the side, with a rounded bottom (the cup) followed by a smaller consolidation (the handle).

Key Characteristics of a Cup and Handle Pattern:

- Cup Shape: Rounded, U-shaped bottom indicating consolidation.

- Handle Formation: Slight downward or sideways price action following the cup.

- Duration: Typically lasting from 7 weeks to several months.

- Volume: Volume usually decreases during the cup formation and slightly increases during the handle, followed by a significant spike on breakout.

How to Identify a Cup and Handle Pattern?

Recognizing a legitimate Cup and Handle pattern is crucial. Here’s how you can do it:

Step-by-Step Identification:

- Spot the Cup: Look for a gradual price drop and subsequent slow recovery, forming a rounded shape.

- Check the Depth: The depth of the cup ideally should be no more than 30-35% from the cup’s high point.

- Identify the Handle: Post-cup consolidation, usually a slight downward drift lasting from a week to several weeks, but should not retrace more than half the depth of the cup.

- Volume Confirmation: Decreasing volume during the handle and a spike in volume on breakout.

Real-World Examples of the Cup and Handle Pattern

Example 1: Apple Inc. (NASDAQ: AAPL)

In early 2021, Apple displayed a clear Cup and Handle pattern. After forming a rounded bottom, Apple stock consolidated slightly, creating a handle before breaking out strongly and making substantial gains over the next few months.

Example 2: Bitcoin (BTC)

In cryptocurrency markets, Bitcoin showed a textbook Cup and Handle pattern in late 2020 before skyrocketing to its all-time high in April 2021, providing traders significant profit opportunities.

Actionable Trading Tips for the Cup and Handle Pattern

Trading successfully with the Cup and Handle pattern requires precision. Here are actionable tips to maximize your profits:

- Wait for Confirmation: Always wait for a breakout above the handle’s resistance line with increasing volume.

- Setting Stop-losses: Place a stop-loss slightly below the handle’s lowest point to manage risk effectively.

- Target Profits: A common profit target is the height of the cup projected from the breakout point.

Common Mistakes Traders Should Avoid

Avoid these common mistakes to ensure successful trading:

- Premature Entry: Entering a trade before a confirmed breakout.

- Ignoring Volume: Trading without volume confirmation reduces accuracy.

- Incorrect Pattern Identification: Mistaking irregular patterns as valid cup and handles.

Latest Trends in Cup and Handle Trading (Stocks and Crypto)

In recent years, especially within cryptocurrency markets, algorithmic trading bots increasingly identify Cup and Handle patterns, automating breakout trading strategies. Moreover, advancements in technical analysis software now provide traders with sophisticated tools to identify and validate patterns quickly and accurately.

Emerging trends:

- Increased use of AI-driven trading software for pattern identification.

- Enhanced predictive analysis using machine learning to improve pattern reliability.

- Growing popularity in cryptocurrency markets due to the high volatility and clear breakout signals.

Conclusion: Why Mastering the Cup and Handle Pattern Matters

Mastering the Cup and Handle pattern equips traders with a powerful tool for spotting high-probability bullish breakouts. Whether trading stocks or cryptocurrencies, understanding and correctly interpreting this pattern can significantly enhance your trading success. Incorporate this knowledge, stay patient, wait for confirmation, and you’ll position yourself to capture profitable market moves consistently.